Increased Raw Materials Cost (RMC)

from the Supply Chain – due to raw material scarcity, Increased input prices, Inflation, and the need for more

MAS has always been a pioneer in apparel. But as the world changes, we’re facing new challenges. Here’s a reality check:

We’re not as profitable as we used to be, and we need to find new ways to deliver value.

Our size and structure are slowing us down—customers, vendors, and even our own teams find it hard to navigate.

We rely on customer analytics without anticipating consumer needs to respond in real-time.

Our web of suppliers, vendors and partners is too complex and unfocused, making us slow and inefficient.

To top it off... the industry has changed: Profitability is now spread across the value chain and away from manufacturing. If we stand still – if we stick to the same structures and processes we are familiar with, the world will move past us.

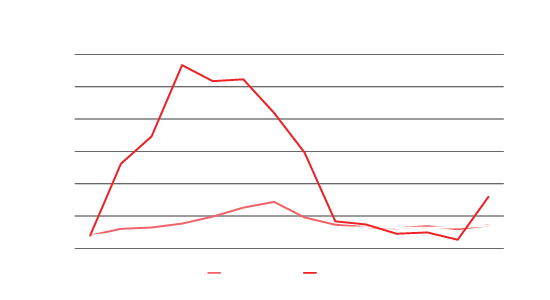

Several key factors over the last few years have resulted in the continued erosion of profit margins in the apparel manufacturing industry, and specifically at MAS.

from the Supply Chain – due to raw material scarcity, Increased input prices, Inflation, and the need for more

due to rising operational cost, drop in MOQs and demand volatility leading to idle capacity

due to an increased Competitive Intensity, with competitors to MAS being faster, more agile, more focused, using better materials, Quicker PO to DC & innovation cycles and better integration with supply chain

from the Customer due to retail price indices being lower than inflation, increasing demand volatility, market fragmentation and their pivot to being responsive over reactive

To be competitive, MAS must pivot to be masters in product superiority, cost leadership, and speed to market.

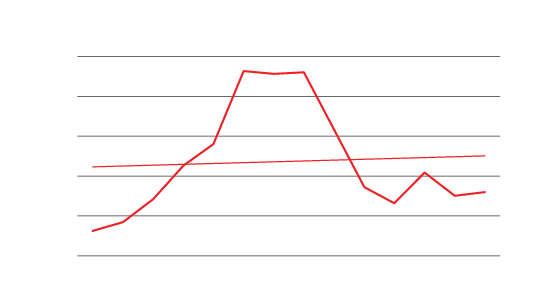

Traditional cut & sew manufacturers have not reached double digit margins in recent years

Manufacturers with vertical solutions have succeeded in surpassing a 10% bottom line

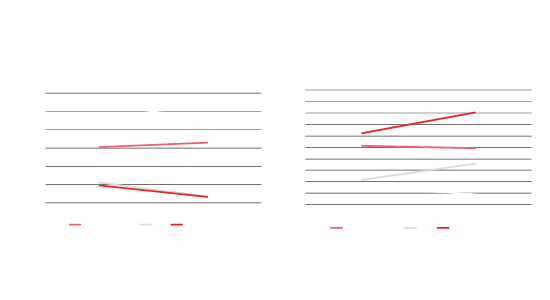

The world order is re-organising around regional blocs

Technological innovation is critical to be globally competitive

The global talent pool is changing

Investing in alternative materials, circular solutions, renewable energy and supply chain resilience

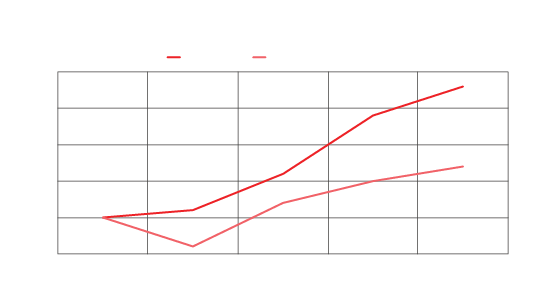

India expected to grow at over 12% annually

North America is a slower-growing market, but remains critical

Market volumes will rise, but inflation will erode real value

To be competitive, MAS must pivot to be masters in product superiority, cost leadership, and speed to market.

Our strategy for 2030, built on our learnings and insights from across the MAS Group and all our stakeholders, is a strategy for MAS, by MAS, that opens new possibilities for profitable growth in a rapidly changing world – it is a reimagining of our future.

Reimagining our future...

For MAS to lead and thrive once again, we’re transforming into a leaner, simpler, future-oriented organization.

This means :

Becoming truly One MAS

To achieve double-digit margins

By optimizing operations, reducing waste, and using analytics to improve speed and decision-making.

Embodying speed, simplicity, and care for people and the planet.

Optimize & Grow the Core

Re-orient value proposition to optimize and fully realize potential of core categories & markets through operational excellence

Integrate & Influence the Value Chain

Strategically partner with and invest in a digitally connected forward-and-backward-integration

Servitize & Monetize Knowledge

Identify and explore the earnings potential of asset-light servitization of MAS’ knowledge

New ways of thinking, and key shifts will have to take place to enable this journey

Harness real-time consumer data to anticipate needs and develop products that truly resonate.

A single interface for the customer, offering the full range of MAS’ advanced tech, capabilities, and products

Strategic global footprint optimizing our target markets, leveraging duty benefits and regional value.

Stronger, faster and more innovative supply chains through regional verticality, strong partnerships and material innovation.

After extensive background, preparatory work and validation through MAS leaders and experts, the outline of the strategy and the key shifts that MAS would make to achieve the desired outcomes was shared with senior leaders in Q4 of 2024.

The roll out of the entire strategy is a phased approach leading up to 2030 and progress will be regularly reviewed by the MAS Board and check and adjustments made accordingly.

The strategy outlines significant shifts that should take place across the MAS Value Chain that would transform:

Simplified, clear and more efficient workflows at a company that works smarter (not harder) and offers more balance.

Access to the right tools and data to make better decisions, act faster and contribute meaningfully.

Creating a sustainable future - not just for MAS, but for our industry and our planet.

To succeed we need your ideas, your collaboration, and your belief in what we’re building together. These changes are happening with you and your role will directly shape MAS’ future and how we’re seen on the global stage-

No, our reason for existing as an organization, our purpose, is unchanged. And our north star for 2030 aligns perfectly with not just the purpose, but also our Vision and Mission as an organization. In 2030 and beyond, MAS’ purpose is -

To Be Changemakers - enabling dreams and enriching the fabric of life on our planet.